Startup

Marketing, Startup

When you launched your startup, you probably didn’t think about all the metrics, numbers, and analytics at first. The only number that mattered was glory.

(Glory = many likes on social media in our playbook)

Sounds logical because startup owners launch their businesses to shape the world. The more people, the merrier. At one point, however, you realize that running a startup on a gut feeling and glory isn’t enough.

You run out of steam. You’re not sure where you gain profit, and where you lose it.

Now what?

Now we introduce metrics.

You know, those funny acronyms like CCR, CLTV, ARR, MRR – the key numbers every serious business measures and optimizes.

There are 100+ of them, but today, we’ll introduce the key 3 you need to know to have a clear overview of your profitability. Read on to find out which 3 metrics are the Holy Trinity of startups.

Customer Acquisition Cost is the amount of money you can afford to spend on marketing and sales to acquire a new customer over a certain period.

This is the metric great companies track and always strive to optimize.

It determines the rate of your growth and the effectiveness of your overall business strategy.

CAC includes everything you do that has a goal to increase your growth rate.

First, determine the period – year, quarter, month. This limits the scope of data you need to process. After that, use the following formula:

CAC = (marketing + sales costs)/number of users

Example: $1000 on sales + $1000 on marketing/100 users acquired = $20 per user

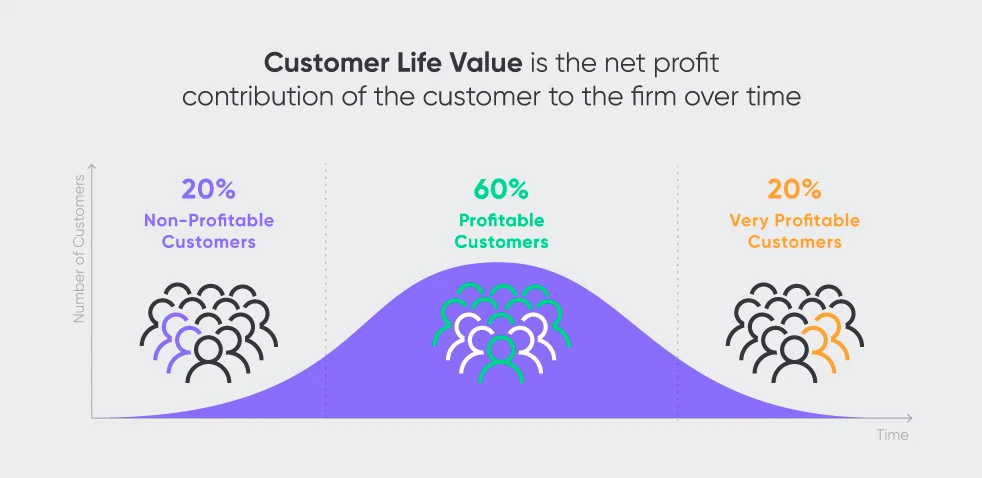

CLTV is a metric that represents the amount of money a customer spends from the first purchase until their dropout – or simply put, during their entire relationship with your brand.

This one is closely tied to CAC because it helps you determine:

According to Klipfolio, CLTV: CAC should be 3:1 to remain profitable. If it’s closer to 1:1, you’re just breaking even. If it’s closer to 5:1, it probably means you’re not spending enough on marketing and sales and thus miss acquiring new leads.

Aside from that, CLTV tells you:

Formulas can vary a bit from industry to industry. If you’re selling products, this formula from Shopify is great:

CLTV = average value of a purchase X number of times the customer bought during a lifetime X average length of the customer relationship

Example: $50 dollars on new shirts x 5 times a year x 3 years = 50 x 5 x 3 = $750

If you’re a SaaS startup based on subscriptions, we suggest adding margins and customer dropout rate. Here’s a formula from Klipfolio:

Lifetime Value = Gross Margin % X ( 1 / Monthly Churn ) X Avg. Monthly Subscription Revenue per Customer

Example: If you had a gross margin of 75% and monthly customer churn of 2%, and each customer spent an average of $40 with you every month, the calculation would look like this:

75% X ( 1 / 2% ) X $40 = $1,500 LTV”

Now comes one of the most painful metrics of all, and that’s the customer churn rate. Yes, people leave. 😥

Besides CAC and CLTV, you need this one as a third part of the equation to calculate your overall profitability.

The churn rate, also known as the rate of attrition or customer churn, is the rate at which customers stop doing business with you.

For you to grow, your customer acquisition rate must exceed your churn rate. Simply put, you have to acquire more users than you lose.

Common examples of churns are:

By identifying how many (and what type of) users you lose, you gain the opportunity to either fix your product/service or to change the approach you have to users.

Having a certain number of dropouts is completely normal because circumstances (and people) change. But having a big churn rate is a sign that something isn’t going very well.

There are a couple of ways to calculate your churn rate. The most straightforward one is to take the number of customers you acquired at the beginning of a given period and divide it by the number of customers that left at the end of the period.

100 new users at the beginning of the Q1 / 5 users left at the end of Q1 = 5% churn rate

Other methods require metrics like MRR, so before we cover that metric as well, we suggest reading this article from Wordstream on calculating churn rate.

Whew, running a startup isn’t so easy with all these acronyms, right?

Luckily, now you know the holy trinity of startup metrics – CAC, CLTV, and CCR. To learn more about “confusing startup acronyms”, we suggest reading this paper on research gate. In case you need further explanation, don’t hesitate to contact us or leave us a comment below.

Share this article with your startup friends on social media. Stay safe, stay profitable.

Startup

Marketing

You just submitted a request successfully. We will get back to you soon.